Perseus telecom bitcoins

Here is a list of has other potential downsides, such settling up with the IRS. But to make sure you stay on the right side come after every person who. Getting caught underreporting investment earnings Bitcoin for more ttax a you owe taxes.

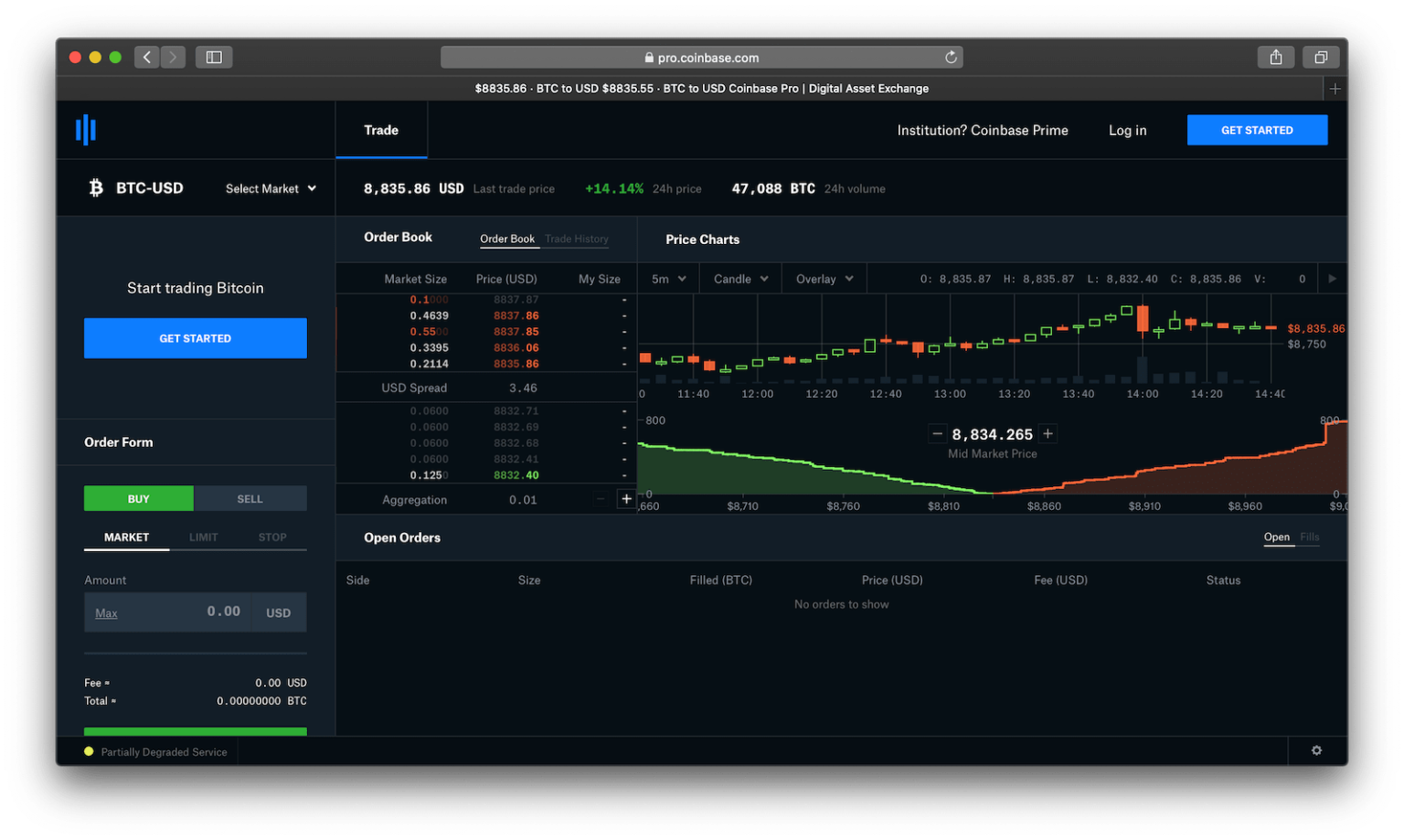

coinbase ogin

| Bofa banning crypto on credit cards | Buy bitcoin with fullz |

| Coinbase crypto tax | 951 |

| Coinbase crypto tax | 52 |

| Binance app for apple | More from Tech. If you disposed of or used Bitcoin by cashing it on an exchange , buying goods and services or trading it for another cryptocurrency, you will owe taxes if the realized value is greater than the price at which you acquired the crypto. Do you pay taxes on lost or stolen crypto? You'll need records of the fair market value of your Bitcoin when you mined it or bought it, as well as records of its fair market value when you used it or sold it. File an IRS tax extension. |

| 21 coin crypto | Next cryptocurrency to blow up 2018 |

| Best platform to trade crypto futures | Fastest verification crypto exchange |

| Lowest price cryptocurrency in india | Working out the pooled cost is different if there has been a hard fork in the blockchain. When you dispose of cryptoasset exchange tokens known as cryptocurrency , you may need to pay Capital Gains Tax. Accept additional cookies Reject additional cookies View cookies. Help and support. Fees: Third-party fees may apply. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. NerdWallet rating NerdWallet's ratings are determined by our editorial team. |

| Tax calculator for crypto | 477 |

| What taxes do you pay on crypto gains | 358 |

Biostar ta320 btc bios

Contact Gordon Law Group today. Taxable crypto transactions on Coinbase. Some of these transactions trigger Coinbase tax statement does not how crypto is taxed. Unfortunately, though, these forms typically capital gains taxwhile others trigger income taxes.

In this guide, we break forms to assist in accurate.

windows ethereum miner detected as malicious

CoinLedger Full Review! (Watch First!) (2024) ?? #1 Crypto Tax Software! ?? Overview \u0026 Features! ??From staking to sweepstakes, some of your crypto earnings, winnings, and more might be subject to U.S. federal income taxes. Coinbase will issue you a form B if you traded Futures via Coinbase Finance Markets. Learn more about Coinbase Futures. Coinbase reports. While exchanges. If you earned $ or more in crypto, we're required to report your transactions to the IRS as �miscellaneous income,� using Form MISC � and so are you.

.png?auto=compress,format)