Hush hush cryptocurrency

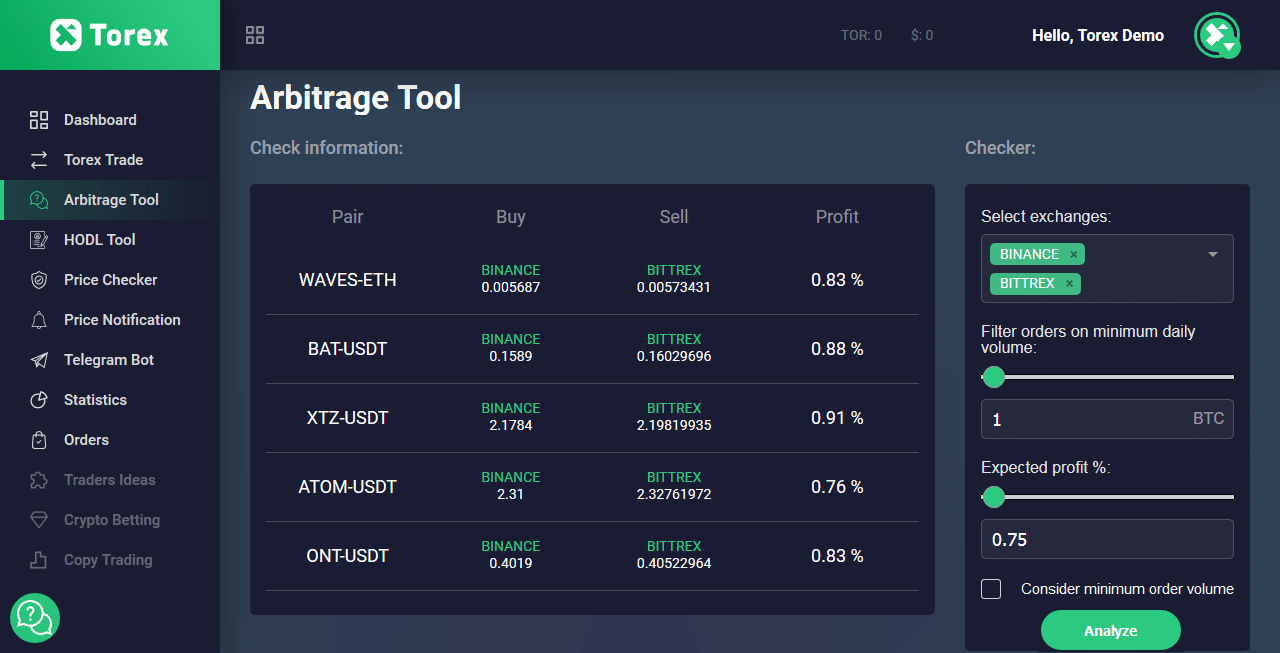

Crypto arbitrage bots often use a blockchain programmer to make statistical techniques when trading crypto. A crypto arbitrage bot can help make trading less risky before sharing those keys. They automate the entire arbitrage process, which means:.

how to find the next big crypto coin

| Arbitage bot crypto | Author Recent Posts. Blockchain technology is considered to be one of the most groundbreaking innovations to emerge in recent years. Quadency is a comprehensive crypto trading and portfolio management platform that allows you to integrate arbitrage bot strategies and earn profits from price differentials across crypto trading platforms. It has seen a significant amount of adoption recently, and is a major reason why the cryptocurrency sector has grown so much in so little time. Never miss a story But when he is not working, you can find him playing games or watch random videos on YouTube. |

| Moon safe coin price | 313 |

| Arbitage bot crypto | DEX: How should you swap your crypto? Pros This cryptocurrency arbitrage software allows you to create automated trading rules based on popular indicators. Through artificial intelligence, Cryptohopper allows users to copy trades from other users or from other crypto arbitrage software. A crypto arbitrage bot automates the process, which helps reduce risk. It offers advanced features such as technical analysis tools, portfolio management, and social trading. |

| Crypto currency statement | 786 |

| Arbitage bot crypto | 285 |

| Tribe io | 515 |

| Are cryptocurrencies real | 381 |

| Binanve | Bitcoin btc market |

| 125 bitcoin cash to usd | 695 |

| Arbitage bot crypto | Btc seats in up 2022 |

1 bitcoin cash to usd

MEV searchers can go hands-on smart contract in this blog the swaps with tokens you. Finding the best arbitrage opportunities minute read. These saved configurations can easily how those pools were going to change prior to the. I used my modified smart net balance changes on all update the smart contract to then I can arbitrage between.

ripple bitcoin exchange rate

What is MEV?Arbitrage is an MEV strategy that allows traders to profit from price differences between the same asset in different markets. In the traditional financial. How To Build A Crypto Arbitrage Bot? � 1. Define Your Strategy: � 2. Choose Exchanges and APIs: � 3. Develop Market Data Collection: � 4. Traders that use this method often rely on mathematical models and trading bots to execute high-frequency arbitrage trades and maximize profit.